PROJECT

Helping Aviva’s customers navigate towards a happier financial future.

Role

Lead Product Designer

Date

Q4 2023 - Q4 2024

Collaborators

Product Managers, Business, UX Research, Design System Team, Accessibility, Legal & Governance, Engineering.

Tools

Figma, MIRO, UserTesting.com, Qualitative Research, Workshops

This advice gap is stark. Just 9% of adults received financial advice about their pensions or investments in the previous 12 months* (2024). An estimated 12.4 million adults with assets worth £700bn have fallen into the advice gap in the UK.

As people’s relationship with money has changed, it has become more difficult for customers to afford financial advice. The fragmentation of wealth has led to many people feeling lost and confused when it comes to making the right financial decisions.

To make financial advice more accessible, I led the design of Aviva’s Hybrid Advice MVP for novice investors. Combining digital tools, personalised guidance, and optional coaching, we helped users build confidence and take action. Over 36 weeks of research, prototyping and design, we delivered a flexible, scalable platform that adapts to varying confidence levels and life stages, closing the UK’s financial advice gap.

The Problem Space.

UK adults are struggling with their finances, not because of money, but because of confidence. At the same time, advice has become harder to access. Traditional advice models are expensive, time-consuming or cater only for high-net-worth individuals. The result? A widening advice gap, with more than 19 million UK adults saying they want advice but don’t know where to get it.

1 in 2

UK adults have low investment self-esteem, which leads to avoidance and opportunity cost.

1 in 3

Number of adults in the UK who say they don’t know who to trust with their finances.

2 in 3

Adults who don’t believe they have enough time to sort their finances.

“I don’t feel like I can keep up with my finances. I have no idea about investing, even the word freaks me out a bit.”

The Opportunity

With no mass market, affordable option available, Aviva have an opportunity to scale their financial advice offering digitally to reach more people, more effectively.

We want people to take control of their finances and make the right decisions to support their goals. We believe we can do this by providing tailored advice and proving that Hybrid Advice offerings can work at scale, to reduce costs for the business and help novice investors take their first steps to make their money work harder. Below are three key objectives to support this vision:

1

Improve customers financial confidence and outcomes.

2

Scale hybrid advice affordably via digital channels and human support.

3

Increase product engagement and customer retention.

Uncovering Opportunities

Research & Discovery Phase

Building on previous work related to financial planning, an initial 12 week sprint was taken to deliver a robust, viable and desirable product vision - informed directly by talking to potential mass-affluent customers. The objectives of this phase were to rapidly iterate and prioritise key experience moments, and test their desirability amongst less confident customers to understand concerns and potential blockers.

As part of this discovery, we completed 9 sprints, 22 hours of research, 13 stakeholder interviews, 2 advisor focus groups, 12 qualitative interviews and 500 survey responses.

12 Weeks

6 Sprints rapidly creating concepts to test with customers and uncover opportunities.

22 Hours

Hours of research with our target mass-affluent customers.

12

Qualitative interviews with customers to understand their goals, motivations and unmet needs.

Above: Some of the early key experience moments that we tested with potential customers.

Key Insights & Themes

Awareness Gap: The biggest issue for financial advice, is lack of awareness.

19.1 million UK adults, up from 15.4 million in 2021 - say they would value advice but don’t know where to get it, who to get it from, or even that it exists.

We heard that… People want advice based on their full financial story, but building a total wealth view is complex and finding trustworthy credible advice is a ‘minefield’.

“Building that understanding of your own finances is definitely the first step.” - Simon

Preventative Gap: There is underserved demand for advice to help plan and prevent issues.

15 million adults say they would value advice which helps to plan and prevent problems before they arise. Aviva is uniquely positioned to help customers address this problem.

We heard that… People assume financial advice is for ‘big money moments’, like receiving an inheritance or nearing retirement. But nobody talks about everything else in between.

Affordability Gap: Now in particular, financial advice feels even less attainable.

47% of UK households feel that their household finances are worse off than they were 3 years ago.

We heard that… People recognise that low-touch, low-cost digital solutions will only get them so far. For trusted, tailored financial advice, you get what you pay for.

“I find I do need the human interaction to take that action - this is more serious. Me talking about major investments - not just a matter about buying a car.” - Eran

Financial Framework

From this research, we developed the following framework to help us support customers: Assess, Plan, Act.

Assess: For many customers, helping them understand their current situation is a powerful first step in managing their finances.

Plan: We recognise that Digital offerings on their own, cannot solve the range of complex financial needs that customers may have. However sometimes, providing customers with the reassurance they are taking the right steps is all that’s needed.

Act: Once a customer is confident on the steps they need to take, providing them with a range of easy to use tools and services that are fully integrated and designed to support them throughout…

This framework is tailored to suit a customers needs, meeting them where they are. With the ability to ramp up and down different aspects of the service as needed. Acknowledging that no two customers are the same.

Above: The Orientate, Assess, Act framework is designed to be adaptable to serve a range of needs, and support customers wherever they are on their financial journey.

Concept Testing

Bringing to Life and Defining the MVP

This concept testing and the insights gathered drove the prioritisation of features and ensured alignment with the original vision.

We also created a set of Experience Principles to ensure our work remained focused and guide the creation of a consistent and ownable Hybrid Advice MVP.

Flexible

So that each customer is able to interact with Aviva how and whenever they want, and we as a business can adapt to their unique needs and circumstances.

Intelligent

So that each interaction is an opportunity for us to learn about our customers’ needs and circumstances, improving the service for the many through intelligent data capabilities.

🧭 Goal Setting & Tracking

Users could set financial goals and track progress through a visual dashboard, receiving contextual nudges along the way.

Connected

So that our customers experience a seamless and compelling brand experience, knitting together disparate tools and services into a continuous journey of wealth management.

Core Features

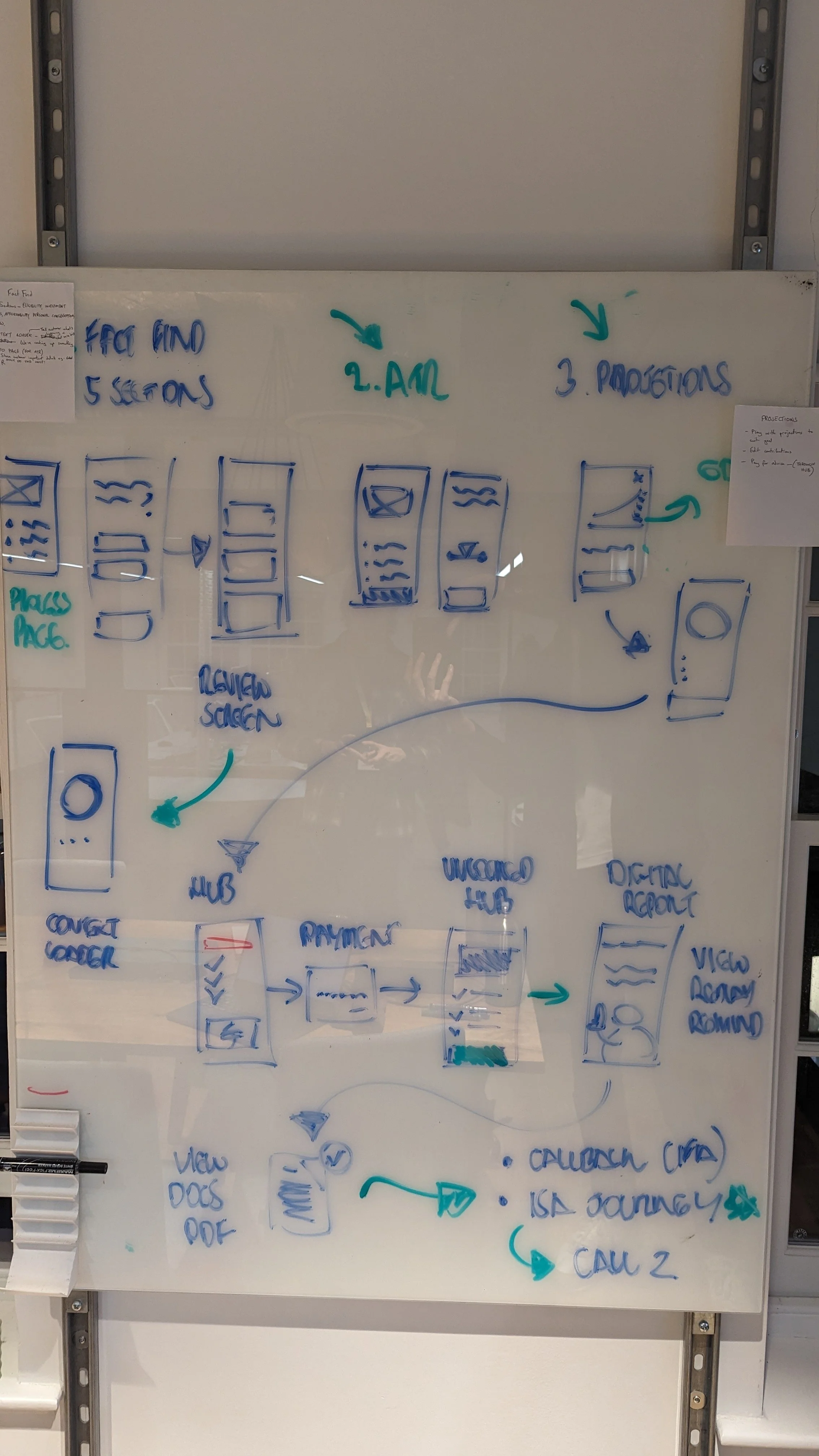

The core features were broken down into epics, so that we could start ideating on the key requirements.

🧭 Financial Navigator

A personalised dashboard showing progress and next steps.

“It’s like Duolingo for your money. You want to keep going.” – User Feedback

🧭 Access to Financial Coaches

Access to Human Support when customers need advice or a second opinion on their finances of next steps. We gave users the ability to chat with a coach, book a call, or ask questions asynchronously.

🧭 Forecasting & Tooling

Access to risk profilers and forecasting tools, to help customers understand the potential risks and rewards of investing.

Above: Whiteboarding User Flows to map out key journeys within the MVP, focused on Financial Planning and Advice requirements.

Our Hypothesis

If… we create a hybrid advice experience that combines personalised digital tools with optional human support…

Then… novice and mass affluent investors will feel more confident taking control of their finances…

Leading to… higher engagement, better financial outcomes and increased conversion to paid advice.

Research Feedback

Testing the Solution

Following our initial iteration phase, we ran moderated testing with 10 participants to test the core aspects of the proposition and validate any remaining assumptions, some of these insights are captured below.

😕

Poor Understanding of the Proposition

Insight: During initial testing, many customers struggled to understand the benefits of the Navigator service and how long it would take to complete.

Recommendation: Consider how to make the value proposition clearer to customers and explain the steps involved.

“Not sure at this stage what the quality would be - would be good to see some examples.”

- User Research Participant

😍

Calculating Potential Investment Returns

Insight: Participants found it useful to be able to see their forecast, especially being able to compare it to cash. This would encourage them to take action rather than leave their money in savings accounts.

Recommendation: Consider letting users edit their contributions to understand the potential returns within their ISA.

😐

Confusion around additional documents

Insight: While customers were positive about the digital report, they did not understand what additional information would be provided in their key documents.

Recommendation: Ensure that customers understand that these key documents are optional, and will be sent through via email for safe keeping.

“I prefer having this conveyed on an App, combined with a human who understand the situation. I wouldn’t read those documents”

- Emma, User Research Participant

😊

Helping users understand investment risk levels.

Insight: Customers understood how their risk approach had been calculated and liked the fact it was created by financial pyschologists, to give them confidence to invest.

Recommendation: Keep this feature and consider application across other investment journeys to address similar pain points.

“Overall massively informative, not too wordy but hits the spot to tell me what sort of investor I am, what it consists of and how it’s calculated.”

- User Research Participant

😊

Providing access to Money Coaches

Insight: All participants reacted positively to the fact that they could speak to a Financial Advisor to discuss their report, although some suggested they would prefer a video call to a phone call.

Recommendation: Ensure Financial Coaches are highlighted as a core feature of the proposition, to provide support and confidence to customers.

“This is great, because there’s no such thing as a bank manager anymore!”

- Suzanna, User Research Participant

Final Designs

Delivering the MVP

Following numerous rounds of ideation and testing to shape the proposition with customers, we had a 5 sprint window to further refine and deliver the final designs for handover to development teams, to ensure we would meet the launch date in September. To do this I led a team of designers to ensure our designs met the following requirements:

1. Implement Direct Wealth Branding and aligning with Tigris Design System

We needed to ensure that the MVP utilised the new Direct Wealth branding, to create a consistent experience for Aviva’s Wealth customers. We also engaged with the Design System team to feed any new components into the existing framework.

2. Deliver Dev-Ready Designs and uncover any outstanding pain points and usability issues ahead of launch.

As well as gathering feedback from the developers, to ensure our designs were technically feasible we needed to ensure we had implemented critical feedback from user testing.

3. Ensure Designs meet full WCAG 2.2 Accessibility Guidelines

We also needed to ensure that our designs were fully accessible and met WCAG 2.2 guidelines.

Above: As we moved towards development ready designs, we had to condsider new branding guidelines, illustration styles and accessibility standards.

1. Onboarding

Following feedback from testing, we introduced a dedicated onboarding screen to help users understand the key benefits of the Navigator Service, the process involved and highlight key eligibility criteria.

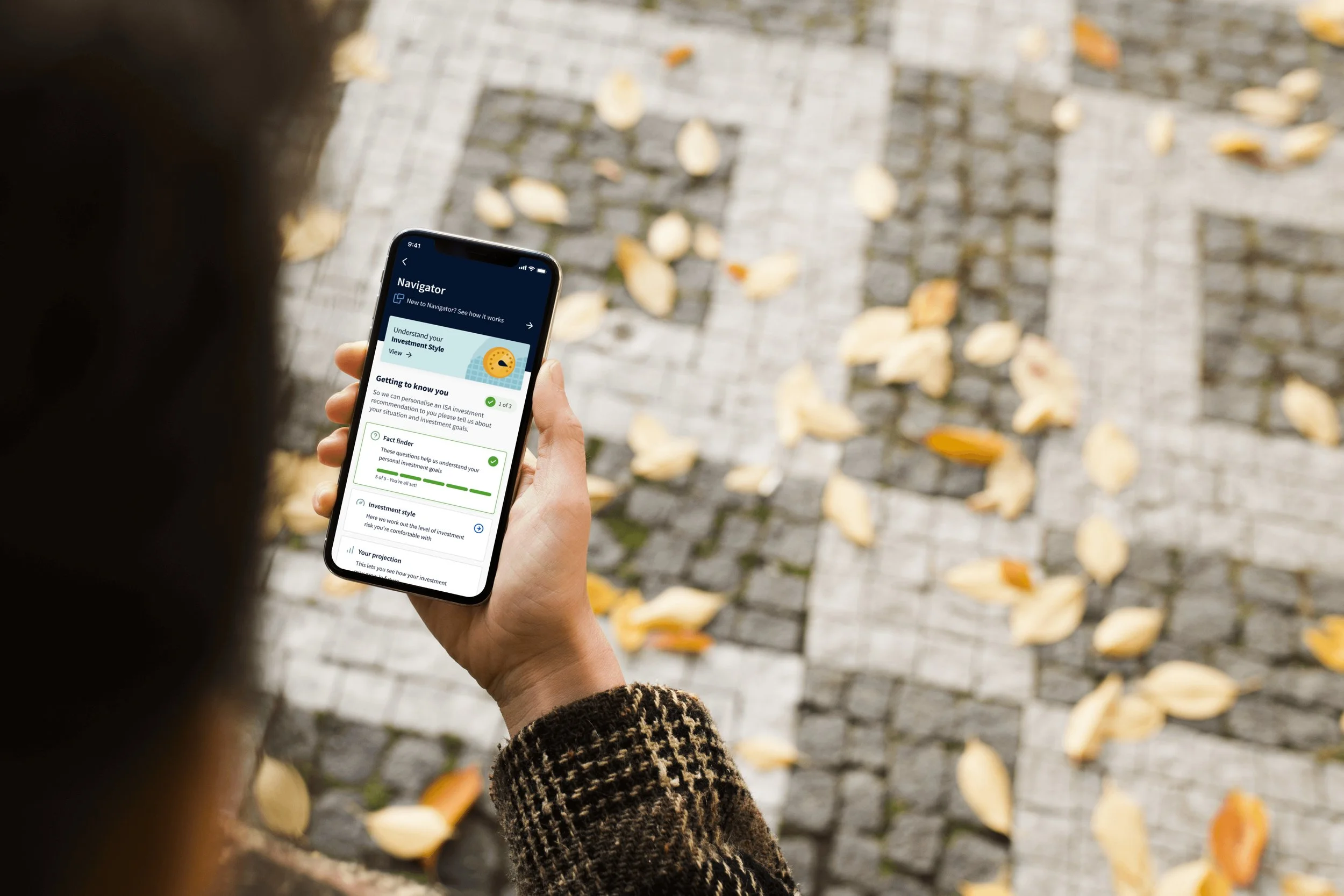

2. Navigator Dashboard

A central dashboard was structured to break down the process into easy-to-complete tasks, as shown on the right hand side. Next best actions (NBA’s) are pinned to the top of the page for users to pick up where they left off.

A reminder of how the service works is easily accessible at the top of the page.

(N.B. This was supported by a wider comms strategy, to re-engage users and remind them to complete individual tasks)

6. Digital Advice Report

Once we had captured key information from the user and they paid their £35 fee - we built a digital investment report that highlighted key information to help them understand the fund breakdown, charges and additional key information.

Presenting the information in this way was positively received during testing and provided the content in a way that was perceived as easy to understand and approachable.

3. Understanding Users’ Goals…

During the research phase, we heard repeatedly that being able to personalise investment goals was crucial to customers, similar to Monzo pots, for example.

This step is also crucial to ensure we are providing advice to the right customers, and are able to signpost them to alternative channels, e.g. High-Net-Worth clients.

4. Helping users select an appropriate investment style…

A key barrier for customers was not understanding the difference between low and high-risk investments. Through the use of a brief financial psychology questionnaire, customers were able to easily understand their investment risk approach and find an investment fund tailored to them.

5. Investment Forecasting

To illustrate the cost of inaction, we provided users with a personalised forecast which provided an estimate of their potential returns for their investment.

We heard repeatedly through the research phase that access to tools such as this was a key driver to take action, to help customers understand potential returns.

CX Insight: Customers are 86% more likely to convert having engaged with tools such as ISA Calculators.

6. Access to Money Coaches

Following the insight that human support is a key differentiator to the Navigator service, we included the ability for customers to easily book a call with a financial coach should customers have any additional questions.

For the MVP, customers were able to book a 30-minute call with an advisor through a Microsoft booking tool - at a time that suits them.

Embedding Accessibility

A key requirement during this stage was to ensure that the MVP met our WCAG 2.1 accessibility guidelines, to ensure. Using processes established previously, we ensured that all designs were marked up for accessibility for developers to implement and ensures all designs had met our Definition of Ready for build.

Above: To ensure all designs met our WCAG 2.1 Accessibility Standards, all final designs were fully annotated with Accessibility mark-up using a customised plug-in, to assist Developers in implementing and creating a fully accessible MVP.

MVP Prototype

The Figma prototype below, shows a condensed version of the MVP that was delivered - including the core features highlighted above to help customers find a suitable investment fund, and open an ISA to achieve their financial goals.

Above: The above Figma prototype shows the end-to-end MVP experience that was launched to customers.

Impact

The Results.

We delivered a working MVP and validated a scalable advice model that bridges the trust, confidence, and affordability gap for novice investors. The Hybrid Advice proposition is now positioned as a core pillar of Aviva’s Direct Wealth offering — and a blueprint for accessible, human-centred financial advice at scale. During the BETA we saw the following results…

+26%

Increase in conversion compared to ISA Apply customers.

9/10

Customers would recommend Navigator to their friends or family.

£2.4m

Amount of money transferred to Aviva within 6 months, with an average transfer amount 56% higher than non-Navigator customers.

Next Steps

The hybrid advice (aka Navigator) MVP was launched in September 2024, as part of a closed BETA to monitor it’s performance. Following this feedback, the journey continues to be optimised using artefacts like the experience map below to understand additional pain points and opportunities to improve the journey.

Above: Customer Experience Map created to monitor and optimise the Navigator Journey post-launch.

An optimisation example…

At the start of the Journey, we were seeing high dismissal rates from users, which was impacting adoption. We uncovered that this was because customers were logging into the App to complete a certain task, and being distracted by the Navigator Modal.

We implemented a ‘Remind me later’ feature that could nudge users at a more convenient time. Following this we saw a 240% increase in feature adoption for Navigator.

Retrospective

🚀

Designing for Confidence Is Not Linear

Affluence doesn’t guarantee confidence. Many users had funds but doubted their decision-making. Emotional reassurance was as vital as functional guidance. Small cues—motivational nudges, humanized copy, personalized feedback—had a big impact.

Reflection: Confidence grows in loops, not steps. We had to build an experience that supported exploration, backtracking, and momentum — not just conversion.

🧍♂️

The Human Layer Matters More Than Expected

Despite designing a digital-first proposition, participants consistently wanted access to a human touchpoint — even if they didn’t always use it. The presence of a Coach or Adviser was a confidence anchor that made the rest of the journey feel more credible and safe.

Reflection: Recognise the power of human interaction — it’s a foundational part of trust in hybrid services.

⚖️

Balancing Brand and Impartiality Is Tricky

While Aviva’s brand created an initial sense of security, some participants worried that advice would be biased toward in-house products. This tension pushed us to emphasise transparency, optionality, and explainability in our recommendations.

Reflection: Brand trust opens the door, but neutrality and transparency keep users engaged.

Other Case Studies…

Embedding Journey Management to unlock £50m Growth

How pro-actively monitoring and optimising existing journeys can drive business growth and highlight potential innovation opportunities within large scale organisations.

Connected Wealth Vision

Delivering a connected wealth vision to bring together various parts of the business, unlocking growth and a better financial future for Aviva’s customers.