PROJECT

Helping customers plan their financial future with confidence.

Role

Lead Product Designer

Overview

Date

June - August 2024

Skills

Product Straategy, Concept Design, UX Research, Prototyping, Stakeholder Engagement

Aviva have ambitions to be a top 3 player in the Wealth space by 2030, with a vision to support customers manage their finances and help them take control of their financial future. To do this, we were asked to define a compelling vision that cuts across the wealth business - Workplace, Intermediary, Retail, Direct and Succession Wealth - unlocking growth for the business and a better financial future for Aviva’s customers.

In a world of increasing financial complexity, Aviva set out to redefine how it supports its customers in managing wealth, planning for the future, and navigating life’s key financial decisions. They approached us with a clear ambition: to create a compelling, unified experience vision that could serve as a north star for internal teams and inspire future product development.

During a 3-month project, working with Product Managers and Researchers I helped bring this vision to life through key customer journeys and a compelling story for Aviva’s senior stakeholders.

The Problem.

Today, Aviva’s mass-affluent customers hold more than £800 billion of assets with competitors.

However there are complex challenges that prevent them from accessing these customers: Fragmented Digital Journeys, different platforms for different products and services, marketing permissions that limit engagement and a lack of customer loyalty. Aviva want to recapture this market share with a Connected Wealth experience that transforms them from a transactional provider to an empowering, go-to Wealth partner.

The Approach.

We partnered closely with Aviva’s leadership to deeply understand the needs, frustrations, and aspirations of their customers — and the business. Through workshops, interviews, and strategic alignment sessions, we surfaced a core insight: people don’t just want to manage their money — they want to feel in control, confident, and reassured about the future.

This became the foundation of Connected Wealth: an experience vision that reframes wealth management around empowerment, clarity, and connected decision-making.

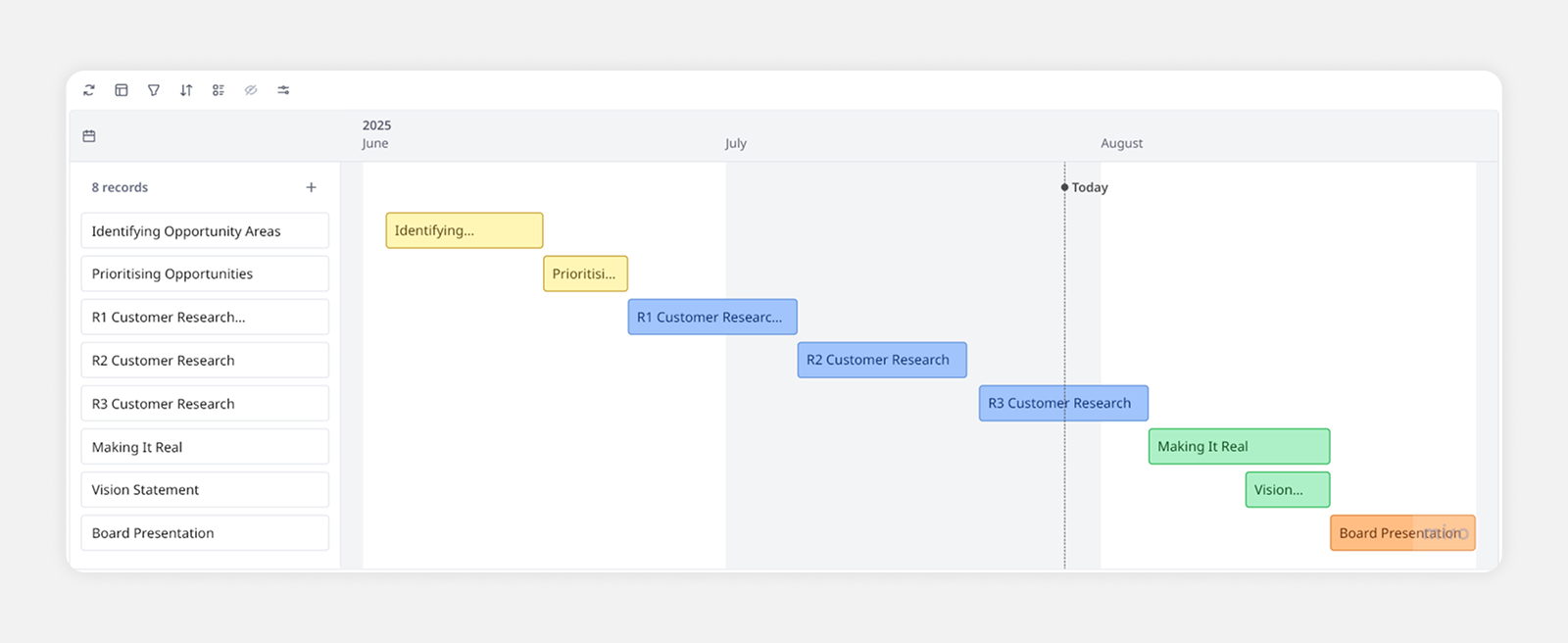

Above: Our project approach captured within a MIRO working board.

From talking to Senior Leaders, it was clear that there were 4 focus areas which we turned into HMW statements to aid the ideation stage.

Streamlined Product Discovery

How might we make it easy for customers to find and choose the right products and services that suit their individual needs and goals?

Flexible Advice

How might we enable customers to mix and match the depth of assistance they require, from guidance to hybrid advice, to IFA’s to Succession Wealth.

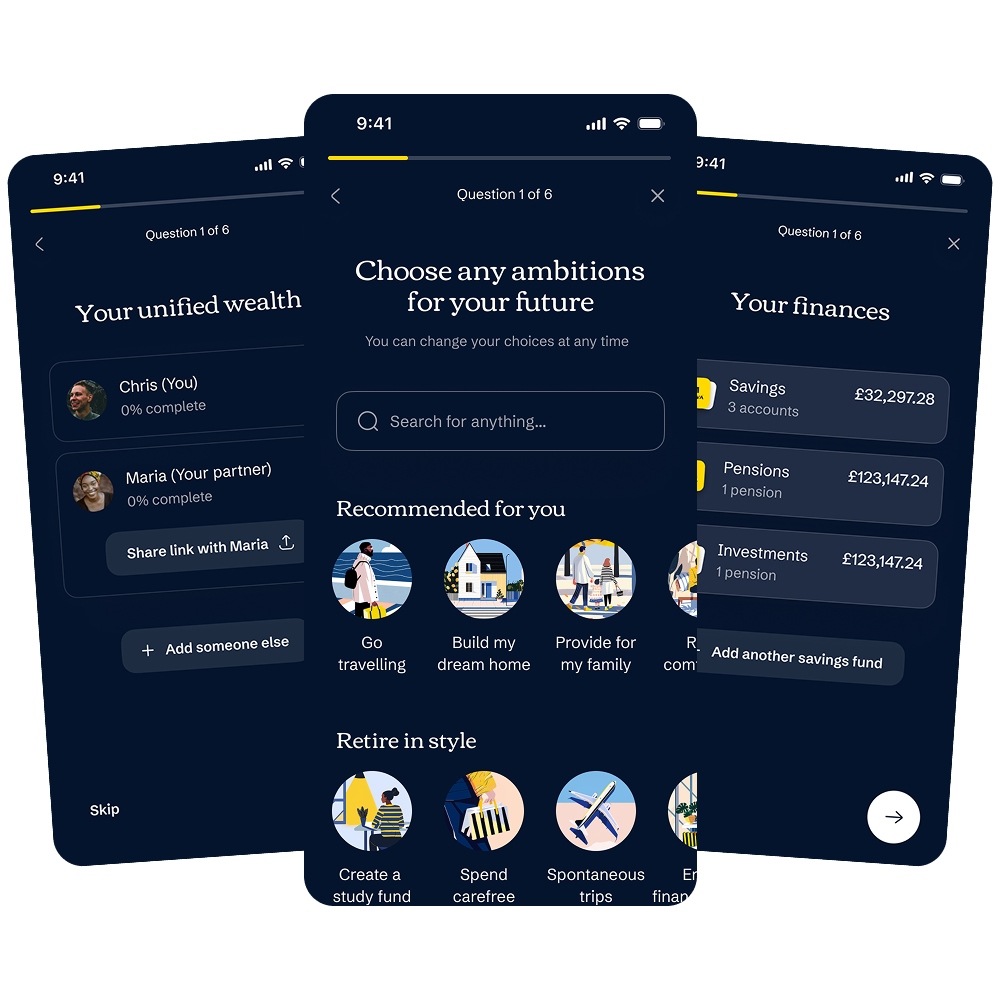

Unified View of Wealth

How might we plot someones total wealth over time so that it builds confidence to engage and make decisions?

Recognise Shared Wealth

How might we recognise and support shared forms of Wealth e.g. parents managing wealth for their children, or busy couples building wealth day-to-day and managing what life throws at them along the way.

Using these prompts, we set about the ideation phase to create a range of wireframes and ideas that supported these focus areas, before sharing them with Aviva’s target customers, running 24 generative interviews during the course of a 2 week sprint.

Talking to Customers

We created a range of wireframes and ideas that supported these areas and shared them with Aviva’s potential customers, running 24 generative interviews over a 6 week period.

What we learnt…

We uncovered some key insights from these conversations with mass-affluent customers.

There’s always something more important to do…

For many customers, wealth planning and management is a necessary evil and something they would rather kick down the road. The consequences of inaction, outweigh the risk of making the wrong decision.

It’s easy to get overwhelmed when making a decision…

Even in big money moments, people want to feel confident they’re making the right decision without investing time and energy to become experts.

“I’m a teacher and spend my whole day reading, I don’t want to have to do the same when comparing my investment products - i’d rather just leave it as is”

“The reason I had a financial advisor is because i’m not great with admin”

“I’d honestly rather go and walk the dog”

“I don’t get too much into the detail, I’m only going to get overwhelmed. I just want to know enough to say, yeah that looks about right, keep it bite sized and simple.

“I like how Plum lays things out, easy to compare and decide. Although if I were to get a crazy amount of money i’d just pay for an advisor”

These insights and findings were fed back into our final designs, to be shared with a range of senior stakeholders and bring a galvanizing vision to life.

Bringing the Vision to Life

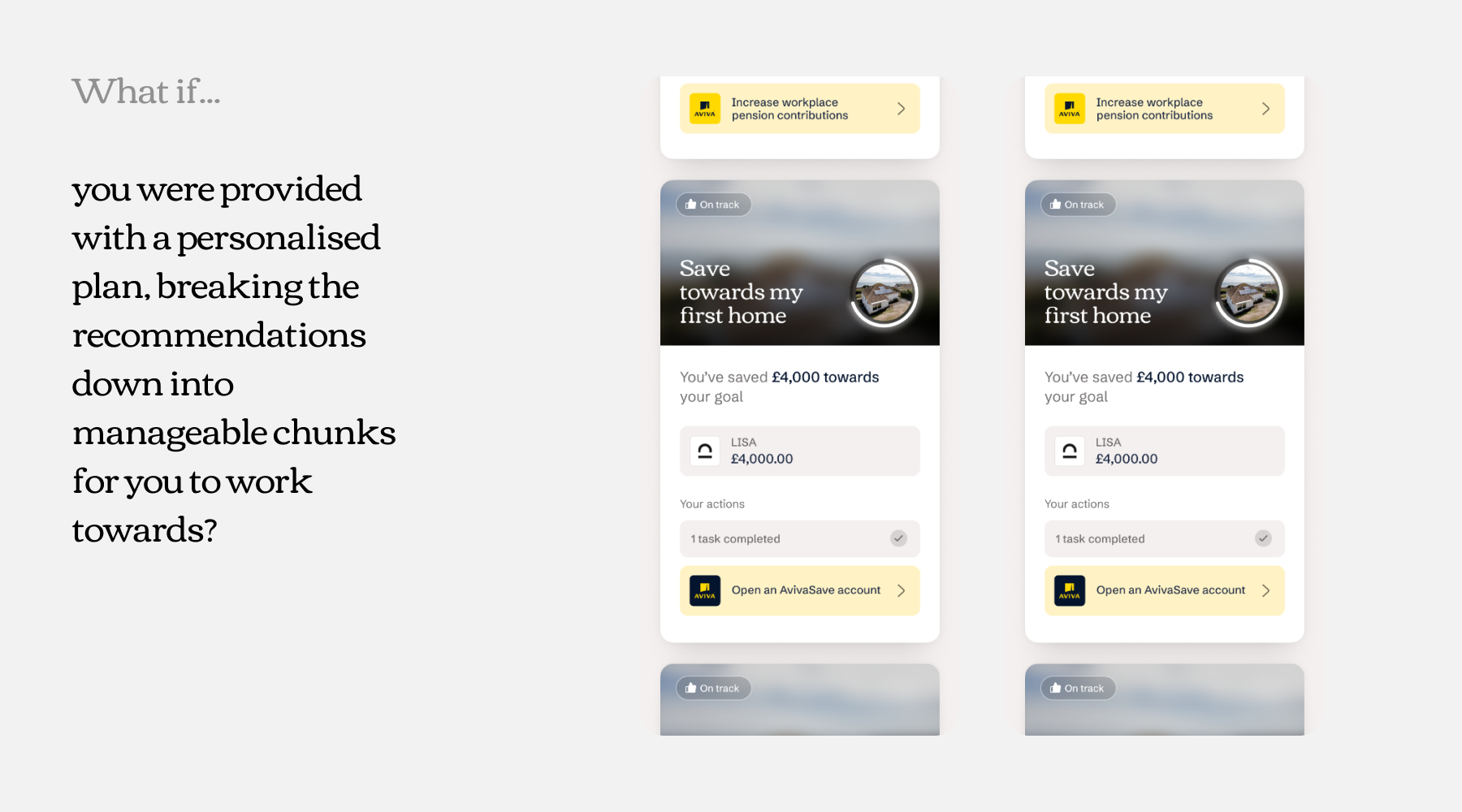

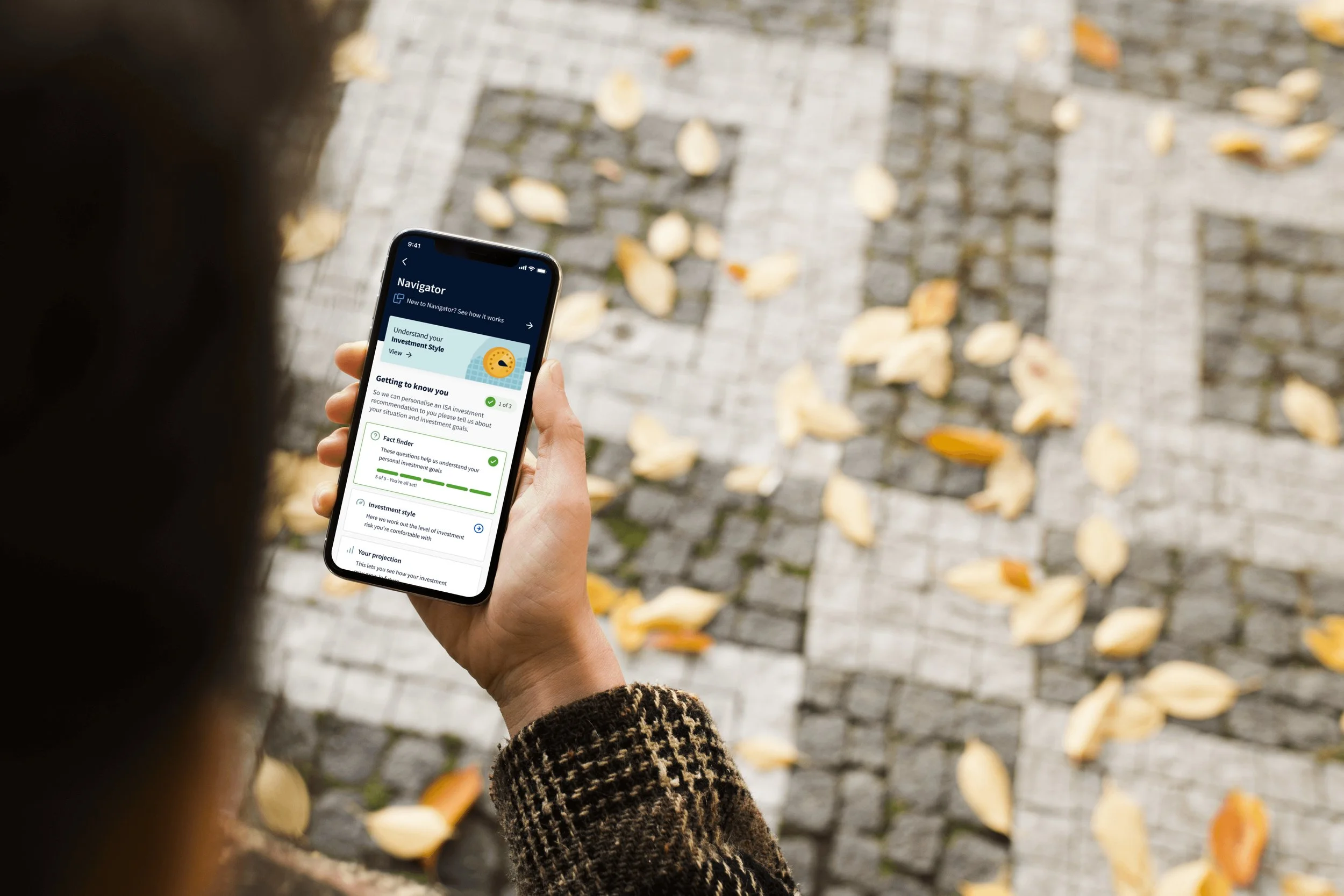

To make the vision tangible and actionable, we designed a high-fidelity Figma prototype that showcased how Connected Wealth could come to life across key user journeys — from intuitive financial dashboards to personalised goal setting and proactive nudges.

We built the prototype to feel like a real product, enabling stakeholders to see, feel, and understand the future experience. We avoided abstract slides and instead presented a living, breathing product vision that resonated at every level.

See Sarah’s Story…

Sarah is approaching retirement, she has a workplace pension with Aviva but is confused about her options. She feels overwhelmed and worried she won’t be able to maintain her current lifestlye. Sarah fits into our ease seeker profile, someone who often just wants to take the path of least resistance but ensure that her money is working hard for her…

Subtitle: Lorem ipsum solor dit amet donde es el cuarto de bano.

“This would definitely help me, I don’t speak to my Financial Advisor often. If I could have a forecast, I would maybe be more pro-active with my finances. If I could do it through this App, it would be so easy”

See Michael’s Story…

The second customer story we brought to life, focuses on Michael, a mass-affluent customer who is always monitoring the market to ensure his money is working best for him. His employer provides a wellbeing programme which suggests he can sacrifice some of his upcoming bonus into his pension, in order to save tax - Michael is a performance seeker.

Key Experience Moments

These stories and features included, support Aviva’s vision to become a trusted Wealth partner, and help people across the UK take control of their finances. Below I have unpacked some of the key features included in the vision…

Wealth Guide

By keeping things on track with targeted insights, actions and education - plus access to real human experts.

“It knows your and your goals, as well as what you want and can help you tailor them to your needs”

- User Testing Participant

Future Wealth

By bringing to life what the future could look like and making it easy to understand how to get there.

“Seeing it in black and white. Someone else has done the hard work for me. Just seeing that I’m on the right track and heading in the right direction.”

- User Testing Participant

Wealth Ambitions

By helping to understand financial ambitions, not just balance statements.

“That feels a bit better as it’s now learning about me, I have a little more trust.

- User Testing Participant

The Results.

In a competitive landscape, forward-thinking organisations need more than just a product—they need a vision that cuts through complexity and motivates action. Our work on Connected Wealth is a testament to how design-led thinking can unlock clarity, inspire stakeholders, and accelerate digital transformation.

A shared product vision that aligns teams and unlocks momentam across the business.

A high-fidelity prototype that inspires and guides future work.

Strategic clarity that helps position Aviva as a leader in the Wealth management space.

Other Case Studies…

Embedding Journey Management to unlock £50m Growth

How pro-actively monitoring and optimising existing journeys can drive business growth and highlight potential innovation opportunities within large scale organisations.

Helping Aviva’s customers navigate towards a happier financial future

The advice gap impacts 21 million people in the UK, leading to poor financial knowledge. How can we make financial advice more attainable and help customers take control of their financial futures?